Other insurance business charged much higher rates after a DUI. The remainder of the finest insurers consisted of in our research study generally doubled their premiums compared to what they supplied a motorist with a clean document. Because of this, it's especially vital to compare quotes from a number of firms when looking for vehicle insurance with a DRUNK DRIVING.

auto insurance cheaper car insurance insure cheapercheap car insurance affordable car insurance cheapest car insured

auto insurance cheaper car insurance insure cheapercheap car insurance affordable car insurance cheapest car insured

This is generally because more youthful chauffeurs are extra most likely to obtain right into accidents than older motorists. That greater threat prompts insurance policy firms to charge higher rates to teen drivers, as well as those that are a couple of years older.

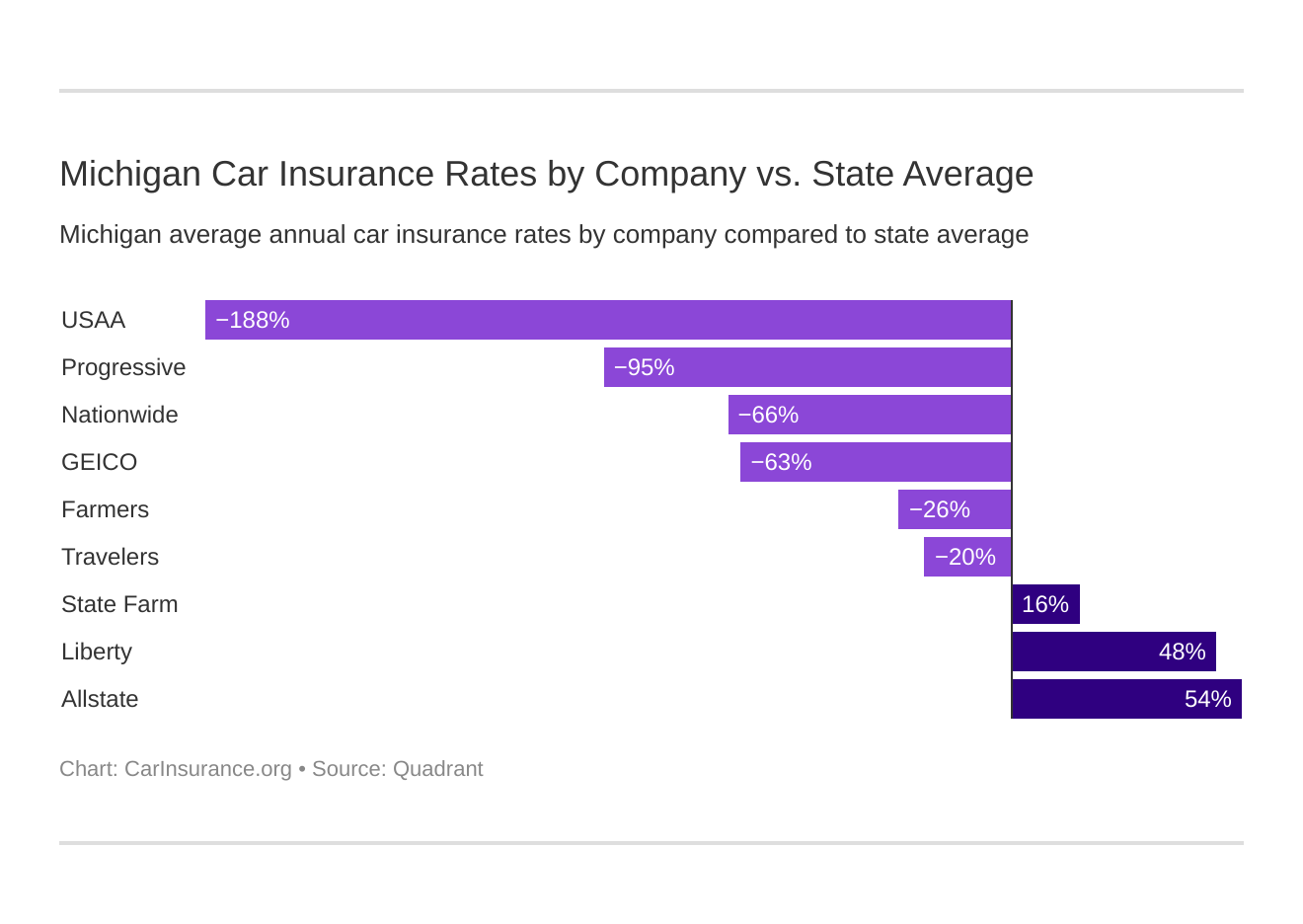

Dynamic, Met, Life and also Auto-Owners are amongst the finest companies for inexpensive car insurance policy, no issue your age. USAA is a great alternative, as well, if you're eligible. It was additionally amongst the top insurer for each and every of these age groups. We didn't highlight USAA below, however, because just experts, current participants of the armed forces and several of their relative get protection.

All content and solutions supplied on or with this website are supplied "as is" and "as readily available" for use. Quote, Wizard. vehicle insurance. com LLC makes no depictions or service warranties of any type of kind, reveal or suggested, regarding the operation of this website or to the information, web content, materials, or items consisted of on this website.

Michigan has some of the most comprehensive insurance legislations in the nation when it comes to no-fault protection. That likewise implies locals below pay the highest automobile insurance coverage prices in the United States. Exactly how much is automobile insurance in Michigan? Some study reveals that Michigan vehicle drivers pay $ 2200 a year in auto insurance typically compared to $1250 throughout the U.S - cheap car insurance.

Michigan Auto Insurance For Educators - Meemic Things To Know Before You Get This

Nevertheless, if the quantity of damages in an accident goes beyond the quantity of automobile insurance policy protection you lug, you will need to pay of pocket for the exceptional prices (vehicle insurance). Although one in 5 Michigan vehicle drivers fails to bring minimal vehicle insurance policy protection, the state does not call for drivers to have underinsured or without insurance vehicle driver coverage as a few other states do.

On top of that, the lot of uninsured motorists in Michigan contributes to high auto insurance policy premiums. Car insurance coverage is most pricey for Michigan homeowners that reside in Detroit, where the average is concerning $6192 per year, complied with very closely by Dearborn, Flint, and Redford, where the average price tops $5000 each year - accident.

com, Quote Wizard, and Worth, Penguin, Detroit citizens who live within the 48227 location cheapest car insurance code pay higher automobile insurance than anywhere else in the USA, with an ordinary annual premium price of $7415. Also terrific chauffeurs will certainly pay high rates for insurance policy in urban areas of the state, while drivers living in rural areas tend to gain from reduced auto insurance coverage costs - trucks.

Speeding tickets as well as other kinds of traffic tickets will additionally create your price to raise. Motorists who have speeding tickets in Michigan can obtain a plan for regarding $1697 for the year from GEICO.Boosting your credit report can additionally reduce your auto insurance coverage bill. Chauffeurs with reduced credit ratings pay concerning 167 percent extra for vehicle insurance policy protection than motorists with good credit rating.

Indicators on Michigan Auto Insurance Refunds Of $400 Due No Later Than May You Should Know

credit vehicle suvs affordable car insuranceinsured car cheapest car credit score insurance

credit vehicle suvs affordable car insuranceinsured car cheapest car credit score insurance

Michigan drivers with inadequate credit score must take into consideration a policy with GEICO. This company offers the most affordable rates for chauffeurs who do not have favorable credit rating, with an ordinary premium expense of $2128 for individuals in this group. Other options for motorists with negative credit consist of: Progressive at $3320 each year, State Farm at $7232 annually, Farmers at $8511 per year, Allstate at $10,386 each year, According to Nerd, Wallet, these are the firms with the very best auto insurance rates in Michigan:$2440 annually at Auto-Owners for vehicle drivers with excellent driving backgrounds as well as clean credit scores$2576 a year from Frankenmuth$3168 a year from Esurance, Research study providers and their choices to locate one of the most affordable vehicle insurance coverage, so you, your family members, and various other drivers will be protected when traveling.

You may be able to discover more information concerning this and also comparable content at piano. io.

Michigan was among 38 states that saw boosted auto insurance coverage rates in 2021, the report located (suvs). In the Detroit metro location, where drivers have actually paid far greater costs for vehicle insurance, the average premium was $3,148, a 2% boost from 2020. Fairly, West Michigan vehicle drivers in Grand Rapids, Kalamazoo and Battle Creek paid approximately $2,462 for car insurance coverage in 2021.

"It's not likely Michigan vehicle drivers will certainly ever before have among the most affordable rates in the country, as chauffeurs in some states are presently paying much less than $1,000 a year, Beck said."There's actually no various other insurance reason why they couldn't obtain to a comparable price as neighboring states," she said.

Patrick Cooney, the assistant supervisor of plan effect at Destitution Solutions at the College of Michigan and also co-author of a current analysis of Michigan's automobile insurance coverage legislations, claimed while rates have gone down across the board, Detroit-area homeowners are still paying a lot even more to insure their lorries. insure."We still see this variation in prices in between Detroit et cetera of the state, and really between any type of postal code with a high share of Black homeowners," Cooney claimed.

Some Known Questions About Car Insurance Costs Are Now Higher For Many Michigan Drivers ....

One choice Cooney said legislators might take into consideration to make prices a lot more equitable throughout the board is needing insurance companies to determine the bulk of their prices on three driving-related elements: miles driven, driving document and years of driving experience. suvs."If you keep attempting to prevent all these factors they can't use, it can transform a little right into a video game of whack-a-mole," he stated.

Currently, just motorists who select endless PIP medical coverage pay the MCCA analysis, as long as the fund does not have a deficiency. A driver's PIP protection political election will not have an impact on the reimbursement quantity. business insurance.

Beck stated refunds can assist "bring back a bit of confidence at the same time" for consumers irritated with paying a great deal of cash for auto insurance (laws)."How insurance policy is supposed to function is that it exists at your worst time," she said. "It does restore faith when they're stating, 'Hey, listen, many individuals paid in and also not sufficient people obtained, let's get back to that equilibrium.'"The 2019 legislation also included modifications to just how much healthcare companies are compensated when treating auto-related injuries, which went right into impact in 2015.

The Insurance Coverage Alliance of Michigan, which stands for a bulk of insurance companies in the state, introduced in December that greater than 150,000 motorists formerly driving without automobile insurance policy have registered given that changes to Michigan's no-fault system went into result. Medical care providers say the modifications have actually decimated their industry and also placed patients that received disastrous injuries in jeopardy - auto.

Cooney claimed the College of Michigan evaluation concluded the price caps included in the 2019 legislation might have been needlessly reduced, keeping in mind there are "extra nuanced means of handling this" that could enable providers to remain to supply treatment without increasing prices. In a December meeting with press reporters, Residence Audio speaker Jason Wentworth, R-Farwell, stated he's open to tweaks, indicating a $25 million pot of cash authorized by lawmakers for post-acute mind as well as back injury centers and also attendant treatment companies seeing architectural losses as an outcome of the brand-new legislation.

5 Easy Facts About Michigan Average Cost Of Car Insurance Rates (2022) - Insurify Shown

"Anything that we do will have that domino effect on that check." (insurance affordable).

Auto insurance policy in Michigan is costly because it's a no mistake state with high insurance policy protection demands. The largest factor Michigan motorists pay even more for vehicle insurance coverage than any person else in the nation is that it is the only state with unlimited. In Michigan, you can expect to pay approximately $3,833 annually for complete protection vehicle insurance or $1,908 each year for minimal insurance coverage.

automobile insurance dui car insurancecheap car risks cheap insurance money

automobile insurance dui car insurancecheap car risks cheap insurance money

As the expense of auto insurance coverage proceeds to climb, much more chauffeurs take the risk of driving without car insurance. In 2019, 26% of drivers did not have even minimum responsibility insurance policy in Michigan.

cheaper auto insurance insure auto cheap insurancesuvs auto perks money

cheaper auto insurance insure auto cheap insurancesuvs auto perks money

In Michigan, weather events like severe storms, serious winter weather, as well as droughts are becoming significantly usual. These climate events trigger insurers to pay a higher number of insurance claims, which tend to be more expensive as well as less foreseeable (cheaper car insurance). Therefore, they need to raise rates to keep up. There could be various other problems boosting your prices.

Some points you can't control, but you do have a say in the majority of the contributing aspects. Driving safely, following website traffic laws, and also maintaining a tidy driving document are the most effective ways to keep your insurance coverage costs down. affordable. Apart from that, the best means to lower your car insurance coverage expenses is to compare rates from a minimum of 3 insurance provider.

All about State Auto Insurance

At a minimum, be sure to check your record and look for rates every three to 5 years, because you might have the ability to get a reduced price if a website traffic violation diminishes your record - auto. In Michigan, the most costly plans cost approximately $7,950, as well as the least pricey insurance coverage costs around $266, when all vehicle driver account information coincides.