The notion that has actually been observed is because of numerous aspects that additionally solidify the situation that 16-year-olds are too young to return to duty. Listed below we detail down the points that play an essential function while the insurance policy business assesses the cost of auto insurance policy for 16-year-old drivers: Age is among numerous factors that affect the cost of automobile insurance for 16-year-old chauffeurs - cheap auto insurance.

Acquiring a cheaper vehicle will certainly not only be economical but will certainly also assist in saving cash on automobile insurance. This is due to the fact that the minimal the automobile's cost, the much easier it will be to discover the components. Higher-end vehicles are extra costly to insure because of the price to repair them.

The next step is spying the very best sort of cars and truck insurance coverage that is finest matched to your requirements and encloses a teen's monetary price quote. With the addition of your teen youngster, the sort of security you need while driving or when traveling will alter drastically. While wondering just how much cars and truck insurance policy is for a 16-year-old, one must be mindful to consist of the expense of the extra coverages that might be needed to acquire.

Residential property Damages Liability protects you from having to spend for an additional party's problems to their vehicle as a result of a mishap that might have happened - cheap auto insurance. Med, Pay is among the most generally utilized insurance coverages that help in paying the clinical costs after a covered accident, no matter that was at mistake.

Some Of Insuring A New Teen Driver Doesn't Have To Break The Bank

credit cheaper auto insurance insurers cheaper car insurance

credit cheaper auto insurance insurers cheaper car insurance

Young adults can anticipate the insurance policy expense to decrease by 9% when they transform 17. We have reviewed that gender also plays a significant role in establishing the car insurance coverage price in the abovementioned paragraphs (credit).

Why do the rates vary in between males as well as females in spite of belonging to the same age? There was a significant distinction in the premiums for each of the insurer. Some offer similar costs quantities varying from $4195 to $4309 while others have much greater premiums, with an ordinary expense of $9327 for male or women teen motorists - cheaper auto insurance.

Statistically, male 16-year-olds are much more most likely to get involved in an accident or get a speeding ticket than a 16-year old female vehicle driver, the premium for females is approximately 16 percent less. However, one should beware as a survey of 3 of the biggest insurance providers found that both young boys and women that just received their licenses can anticipate to pay a standard of a massive $5944 every six months.

There are some remarkable situations where concession can be availed on the expensive cars and truck insurance like every other insurance coverage. Various insurance provider use several discounts to counter the high cost of insurance for young vehicle drivers, particularly the 16-year-olds who are thrilled to drive (cheaper auto insurance). Listed below we note down some aspects that can accommodate the candidates to utilize the discount rate luxury.

The Best Guide To Tips For Managing Teen Driver Insurance Costs

The exceptional pupil group consists of trainees that have a grade point average of 3+ and also have been suggested by their education and learning institute. The students have to be mindful that discounts are available. Insurance policy business likewise give adolescent chauffeurs with a telematics driving tracker, which lowers the prices after showcasing duty as well as showing that you drive securely.

The adhering to benefit is availed by the geographically far-off pupils from their houses. University student or 16-year-old high schoolers who are a lot more than 100 miles away from residence for college qualify to have their insurance prices decreased. The teen chauffeur can obtain a discount on their car insurance policy from most insurance firms by spending for the entire plan in complete, as opposed to damaging the expense up by month (cheaper car).

However, it is constantly excellent to think about exactly how a case will certainly impact your rates. Some insurance policy companies increase the yearly price by a tremendous quantity of $670 per year if you are at fault for a mishap - cheaper cars. The insurance policy process is rigorous as well as intricate, as well as it can be helpful to determine the price.

Most inexpensive car insurance coverage for a 16-Year-Old Here we have actually assembled a list of the cheapest auto insurance policy that can be availed by a 16-year-old that desires to purchase vehicle insurance policy - low-cost auto insurance. While evaluating which insurance policy one desires to purchase, we have to calculate which insurer supplies the affordable costs quantities. $1193 six-month costs or $199 per month.

Not known Facts About Usaa Is The Cheapest Car Insurance For Teenage Drivers ...

$2139 six-month costs or $357 per month. $2401 six-month costs or $400 each month. $2528 six-month premium or $421 monthly. It is essential to point out that the insurance coverage prices above are for minimal insurance coverage. Originally, one have to consider just how much insurance coverage they might need as well as the insurance deductible they are willing to pay with no monetary situation.

Exactly how to get the very best car insurance for 16-year-old motorists Obtaining the finest auto insurance policy for a 16-year-old is crucial given that it ensures safety and security and monetary safety. Although auto insurance for teens can be pricey, you can commonly discover alternatives to fit your budget plan without compromising insurance coverage. One of the best methods to do this is to shop around and also get quotes from several insurance policy business.

So, while searching for a car insurance coverage, one have to be interested in considering offered protection types, discount rates, customer complete satisfaction scores, as well as financial strength. Comparing these aspects, along with price, could aid you find protection that fits your needs. Traffic data for 16-Year-Old chauffeurs Adolescent drivers tend to set you back more to guarantee because they are most likely to get right into mishaps and have a reason to utilize their insurance.

According to information for police-reported collisions, vehicle drivers aged 1617 were associated with nearly dual the variety of deadly accidents than 18- and 19-year-olds for every single 100 million miles driven. So the young chauffeurs behind the wheel are at a greater threat for mishaps - laws. And also there are fewer deaths per head for teenagers than for older vehicle drivers.

The 8-Minute Rule for Adding A Teen To Your Auto Insurance Policy - Incharge Debt ...

low cost auto vans insurers insured car

low cost auto vans insurers insured car

At the age of 17, the insurance policy is not as pricey as it is for a 16-year-old, but still, it is a hefty quantity. cheap Browse this site car insurance. The national annual typical price for a 17-year-old is just over $5,370 for complete protection and also $2,206 for minimum insurance coverage. Hawaii, North Carolina has the least expensive ordinary yearly price for a full-coverage plan for a 17-year-old at simply under $2,660.

car insurance car insured insurance company laws

car insurance car insured insurance company laws

Louisiana has the greatest typical total insurance coverage prices for 17-year-olds Can teenagers have their vehicle insurance coverage policy? Teens are minors, and as a result of the truth they are underage, they generally are not enabled to have their automobile insurance coverage. They will be listed as vehicle drivers on their moms and dad or guardian's policy.

It can be monetarily beneficial to stay on a moms and dad or guardian's plan up until they relocate out as well as establish their house (affordable). Verdict The lower line of the argument is that the price of your cars and truck insurance will depend on where you live and also whether you get your policy or have your name added to a moms and dad's plan.

If the teen driver does not desire to wait, they can get included to their parent's insurance coverage plan - affordable car insurance.

How To Save On Your Teen's Auto Insurance - Cbs News for Beginners

cars auto cheaper cheaper

cars auto cheaper cheaper

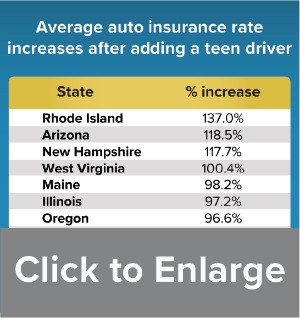

The cost often tends to rise by a standard of $800 per year, current data suggests., what variables influence insurance coverage expenses, and also exactly how to save on insurance coverage expenses.

insurance affordable low cost auto accident cheapest car insurance

insurance affordable low cost auto accident cheapest car insurance

The expense to add a teen onto an insurance plan can be high because of absence of driving history as well as experience, yet it likewise varies based upon numerous factors. Adding teenagers to a parent's plan, sharing a cars and truck, and also preserving good qualities can all help lower cars and truck insurance policy expenses for young individuals.

Generally talking, auto insurance policy immediately includes young motorists. If a young chauffeur is in a automobile accident, after that the vehicle owner's policy will certainly cover the loss. Some insurance carriers are more stringent. They want the permitted motorist to be provided on the plan in order to be protected. To understand what your insurance coverage service provider needs, call and consult with your automobile insurance coverage representative.

Having a teen on an insurance coverage policy is expensive, the majority of states require all vehicle drivers within a household to have car liability insurance policy before they can lawfully drive. By having car responsibility insurance, everyone running the car will certainly be secured for clinical, car repair work, as well as other expenses when the insurance policy holder is at fault in an accident.

The Basic Principles Of Auto Insurance For Teens

As soon as certified, you will certainly then most likely be called by mail, informing you it's time to add the motorist to the policy. How Much It Expenses to Insure a 16-Year-Old Identifying the price of auto insurance policy for any one person is exceptionally challenging to do.

The majority of states need every motorist when driving to have auto insurance coverage, as well as the fines and also costs for refraining from doing so will certainly vary. A teen can be covered by their parents or guardians' policy, or they can purchase your own. In a lot of instances, though, it is much more economical for a teenager to be on their house's insurance coverage.

Companies think about the amount of years you have actually gotten on the road, your crash and also violation history, and the location of where your cars and truck is typically parked. With a young adult on your plan, the price frequently ends up being much more expensive. Normally, a vehicle driver's experience has a huge impact on one's policy (vehicle insurance).

Teenagers are thought about to have a high danger of suing. It is necessary to keep in mind that most insurance firms typically ask for your gender to calculate your home price - laws. Research indicates that, as a whole, men are most likely to drive drunk, enter auto accidents and also, particularly, enter into major automobile crashes.

Getting My The Cheapest Car Insurance For Teenagers In 2022 - Business ... To Work

Still, the majority of people think really feel that individual behavior is a far better sign of an individual's danger than their sex identity. cheap insurance. Great vehicle driver standing can just be gained with time. Prices can come down incrementally with time, relying on your insurance policy provider, but age 25 is when insurance policy prices tend to go down significantly.

Listed below, you'll locate the blunders they most frequently make.: A nervous vehicle driver might focus too much on the automobile in front of them. Teens have a tendency to have tunnel vision as well as stare right ahead, missing out on possible dangers like pedestrians and also animals.: Sidetracked driving can be as hazardous as impaired driving.

: Data reveal that when it involves teens in fatal vehicle accidents, speeding is typically an aspect. cheap car. It might not always be deliberate, but it's hazardous all the very same. Evaluating these typical mistakes with your teenager can aid them be a safer motorist. The vehicle you select for your teenager chauffeur also impacts your insurance rates.

Ways to Conserve Cash on Teenager Vehicle Insurance policy While auto insurance coverage for teenagers can be expensive, there are a few means to conserve. Lots of insurance policy business describe tips, along with bargains, that might be helpful when your teen has to take into consideration automobile insurance. Taking place a Parent's Policy Instead of obtaining their very own plan, it's usually best for a teenager to be contributed to a parent's plan.

7 Simple Techniques For Best Cheap Car Insurance For Teens Of April 2022 - Forbes

Sharing an Auto Having less cars under one policy than motorists is a massive cash saver. Numerous cars and truck insurance coverage carriers will enable the teenager to be added as a second vehicle driver. As an additional vehicle driver, this individual is thought about to not have main access to a lorry, as well as this can assist you pay a lower rate than the key driver.